If your company is a VAT payer, you must configure the VAT settings in Shopify, xConnector and the invoice service platform.

Checkout Shopify

Shopify > Settings > Taxes and duties > enable Collecting tax

Add here all the shipping zones from which you receive orders and need to collect taxes.

Shopify > Settings > Taxes and duties > check the Include sales tax in product price and shipping rate

Shopify > Settings > Taxes and duties > check the Charge sales tax on shipping

Shopify > Products > select a Product > Variants > Edit > check the Charge tax on this product box or Charge tax on this variant (if the product has variants)

xConnector

xConnector > Profile > Connected services > select the invoice service you use > Invoice preferences

VAT payer - mark the store as a VAT payer in the selector

VAT - select a VAT rate. It only applies when you activate the Force VAT payer option.

Force VAT payer - starts only when you have orders that do not have the correct tax settings and want to create invoices for them. This option overwrites the Shopify VAT information. Don’t forget to deactivate this option after you make the invoices you wish to.

Invoice service platform

Follow the VAT settings according to the invoice service you use and fill in it on their platform.

As a result: Shopify calculates the VAT as included in the total (for both the products and the delivery)

Check if you followed the settings correctly:

- Shopify > click on the order's number > check the order details

Important note!

(EN) VAT settings do not apply to existing orders but only to those received after you configured the VAT settings. For the already received orders (before you did the VAT config) use the Force VAT

option and the VAT rate you need on the invoice then uncheck it after you generate the invoices received before the correct settings. “Force VAT Payer” is an option that overrides the VAT rate calculated by Shopify—but it only supports a single, global rate, not two separate rates. xConnector - Profile - Connected services - click on the Invoice service - click on Invoice preferences - Force vat payer

---------------------------------------------------------------------------------

(RO) De retinut este ca aceste setari de TVA (odata configurate) se vor aplica doar comenzilor nou primite.

Pentru comenzile vechi - adica primite inainte de setarile de TVA corecte si complete - va trebui sa folositi optiunea Force vat payer: Yes

Dupa ce procesati comenzile vechi - adica primite inainte de setarile de tva corecte si complete - scoateti optiunea Force vat payer: No Force vat payer este o optiune care suprascrie ce cota tva a calculat Shopify insa e valabila doar pentru o singura cota generala ci nu 2 cote separate

xConnector - Profile - Connected services - click on the Invoice service - click on Invoice preferences - Force vat payer

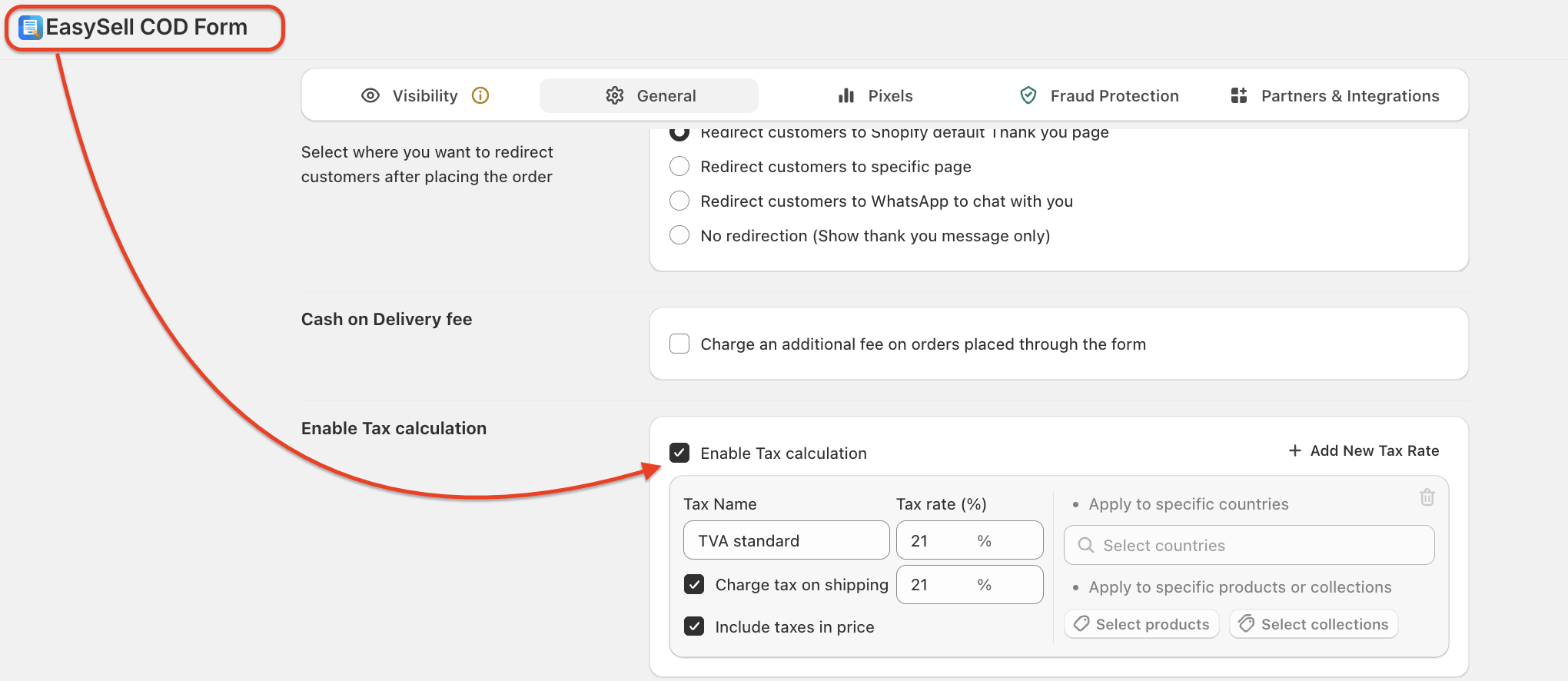

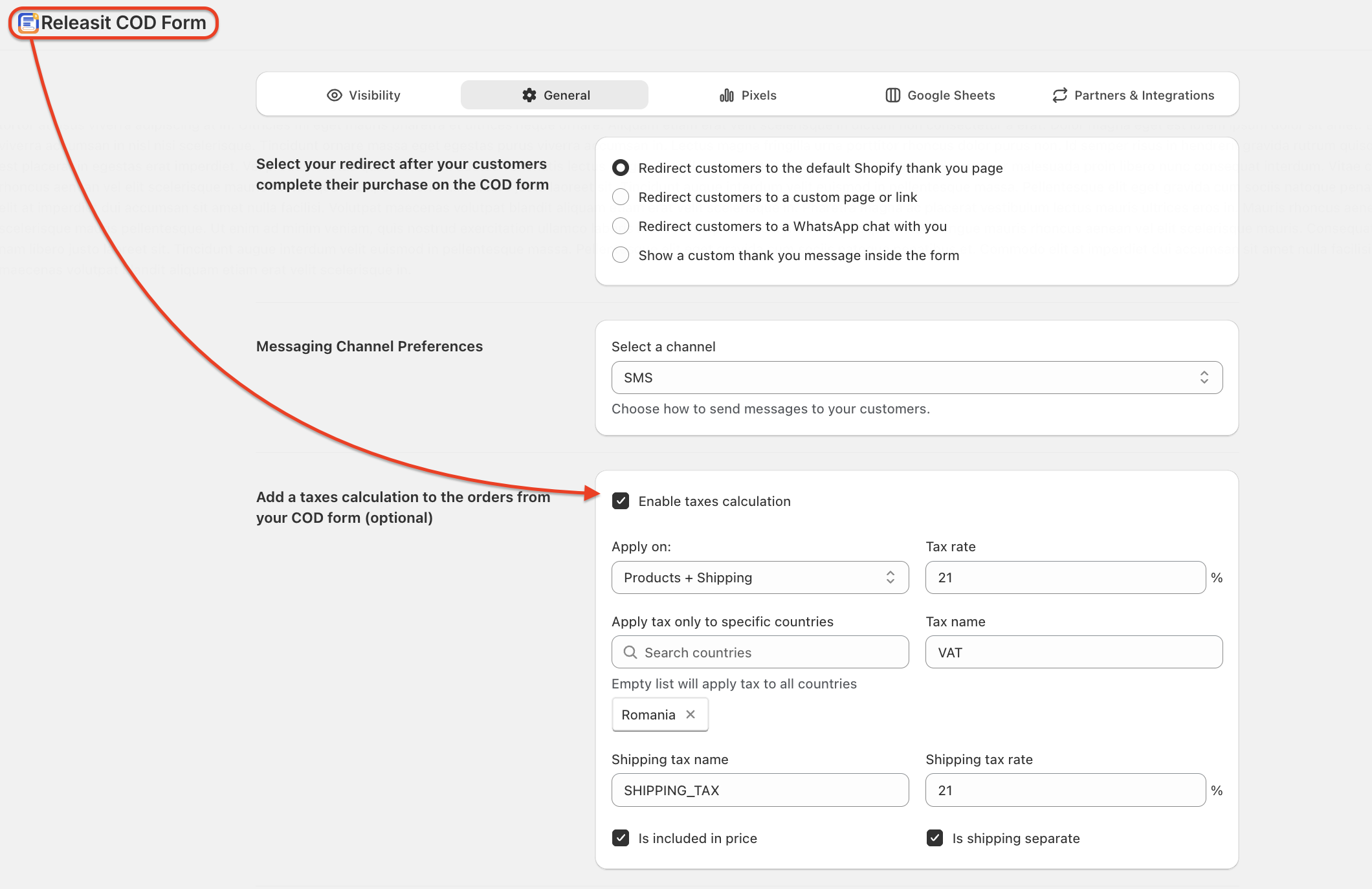

Checkout Custom (Releasit sau Easysell)

Check the VAT settings accordingly with your custom checkout

Make sure you set the VAT for products and for shipping also.

After you set your VAT, check in Shopify if you have correctly the VAT line

Are you using multiple VAT rates in your store? for example: 9% and 19%?

Click here for the settings.

Feel free to contact us if you need any further information:

Chat: click on the blue chat icon (bottom-right)

E-mail: support@xconnector.app

Phone: +4 0373 747 991

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article